I’m getting tired of reading about high mortgage rates and how terrible and abnormal they are.

Always the commentary is on the side of borrowers. But lending companies are middlemen. They rent money from savers, tack on about 3 percent to pay for their buildings, employees, and so on, and lend the money out. When they have to pay savers a lot, borrowing rates are high; when they pay savers are only a little, borrowing rates are low.

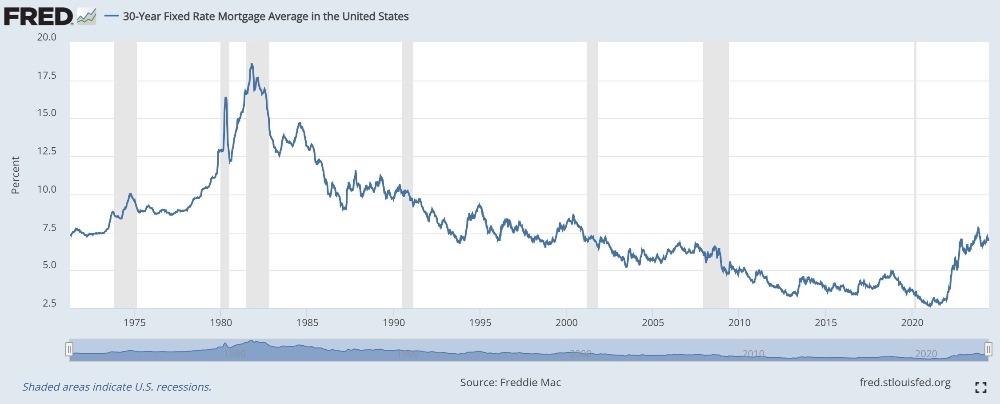

Mortgage borrowers enjoyed 2-4 percent interest rates for most of the 2010s because the lenders were paying savers almost nothing. In some of those years, savers were earning 0.01 percent — one hundredth of one percent. Essentially zero. With inflation, less than zero.

That’s not normal. And it’s not reasonable. Savers should be paid something for the use of their money.

To an older person, today’s “high” rates are what’s normal. As a kid in the 1960s, I remember the bank that took my nickels and dimes paid 4 percent on savings. I note that several banks today are paying 4.25 percent.

Normal.

In the 1970s, rates went up, and for a brief time 44 years ago, money-market funds were offering savers more than 12 percent a year. Mortgage rates shot up above 18 percent, and most sellers had to accept monthly payments instead of cash-outs.

That was a time of abnormally high interest rates. People couldn’t live with rates that high, and they didn’t, for long. But the low rates of the 2010s went on for a long time. To many of today’s young adults, 2-to-4-percent interest on a home mortgage is normal.

Historically it’s not. You may never see rates that low again.

Discover more from Post Alley

Subscribe to get the latest posts sent to your email.

Thank you, Bruce Ramsey, for implying what I have been thinking…that all the hand-wringing about high mortgage interest rates is misplaced. As you explained, rates were far higher in recent memory than they are now. I believe that interest rates were abnormally low for so long that our expectations were geared to a fleeting reality: minimal returns on savings and interest rates so low that borrowed money had become essentially “free” when taking inflation into account.

Real estate agents and prospective home-sellers are hurt by the high mortgage interest rates because they raise the bar to homeownership for first-time buyers and make current owners reluctant to list their current homes, Home affordability is a mix of factors, and mortgage interest is only one: the more basic problem is that prices that could be obtained when mortgage rates were in the 4% range are a hard sell now that rates have doubled.

Thank-you, Bruce.

Thanks Bruce. Perspective isn’t our strong suite these days, is it?

This made me laugh — we bought our first house in 1989, and our mortgage was just about 9%. We managed to refinance a few years later and got it down a couple of points, but even so, it was never below 5%.

Also left out of the discussion is that one could aim to live without debt and have savings, and that low risk income of 5% on savings (brokerage Money Markets pay 5% now) is a huge boon to anyone trying to live past 65 without a 40 hour per week job.

That said, when interest rates were 9% I bought a 1,000 square foot co-op on a premier Capitol Hill street for $110,000. Total monthly cost with dues, taxes, utilities after a mandatory 20% down was $980 per month. The same apartment now lists for $680,000 and I am guessing today’s taxes, HO dues and utilities add $1000-$1500 to the monthly carrying cost. Virtually impossible to save for a purchase like this as a single person if you are paying today’s rents of $25-40k per year. The mortgage alone would be in the 3-4K per month range.

I’m with Anthony! Thanks, Bruce. Perhaps perspective might be useful today. When I left the Air Force in 1974, my wife & I bought a house in the shadow of the Boeing bust for $33K financing the principle after the down payment at 12or13%. This was only possible because I scored a job during an era of high unemployment. Being 20-something, I was too naive to grasp my luck.

True. However, back then one could buy a house for five figures. Now it’s seven figures. I believe today’s would-be buyers would gladly pay today’s high rates if they could buy something for the prices we once enjoyed.