Economic inequality is all the rage.

Bernie Sanders can’t stop talking about it.

Affordable housing advocates can’t, either.

Nor can the burgeoning ranks of the homeless and their advocates. It is a grim sign of the times that California Gov. Gavin Newsom chose to devote his entire State of the State address on February 19 to the homeless crisis.

Even we commoners scratch our heads when we consider that, according to the Bloomberg Billionaire Index, Jeff Bozos’ net worth is 2,287,125 times the median U.S. household income.

Seattle Times columnist Danny Westneat last Sunday offered up a jarring take on just how grossly out of whack Seattle has become in terms of gaping income disparity.

Citing “Parasite,” the startling movie about class divide between rich and poor in South Korea – which made our Vulgarian-in-Chief pine for the slavery-glorifying film, “Gone With the Wind,” – Westneat wrote, “But it struck me watching the tale of the working classes leeching for survival from the basements of their lofty hosts that we in Seattle are so far gone you couldn’t even make a movie here.

“The underclass in “Parasite” at least had places to live, albeit hidden and subterranean. Everybody had plumbing of a sort. Whereas we have thousands of people living on cardboard mats in tents, under bridges or in filth that wouldn’t be presentable at the Academy Awards.”

According to the World Inequality Database, the top 1 percent in South Korea own 25 percent of that nation’s wealth, while the bottom 50 percent owns only 2 percent.

But it’s far, far worse in America, where the top 1 percent own 39 percent of all wealth. More dismaying, though, is the fact that the bottom 50 percent owns less than zero, -0.1 percent of the nation’s wealth. As the Washington Post reported, “While the situation in South Korea is indeed dire, at least the bottom half owns something of value.”

That alone may explain, at least partially, why voters thus far in the Democratic primary/caucus process may not be disposed to give full-throated support to a candidate bumping along in the so-called moderate lane.

Incrementalism is not playing well. Take Mayor Jenny Durkan’s State of the City Address last week, where, after conceding that Seattle has become too costly for many working people, she actually cited the decision to eliminate late library fines as an example of how her administration has “taken bold action” to shrink the chasm between the top and bottom.

Earlier this month, retired Seattle economist Dick Conway put out a 17-page report that essentially blamed Washington State’s recklessly unfair tax system for perpetuating our widening rich-poor gulf.

“It is literally true, and I dare someone to contradict it, that if we reformed our tax system, it would do more to help the poor in the immediate future than anything else,” Conway told me last week.

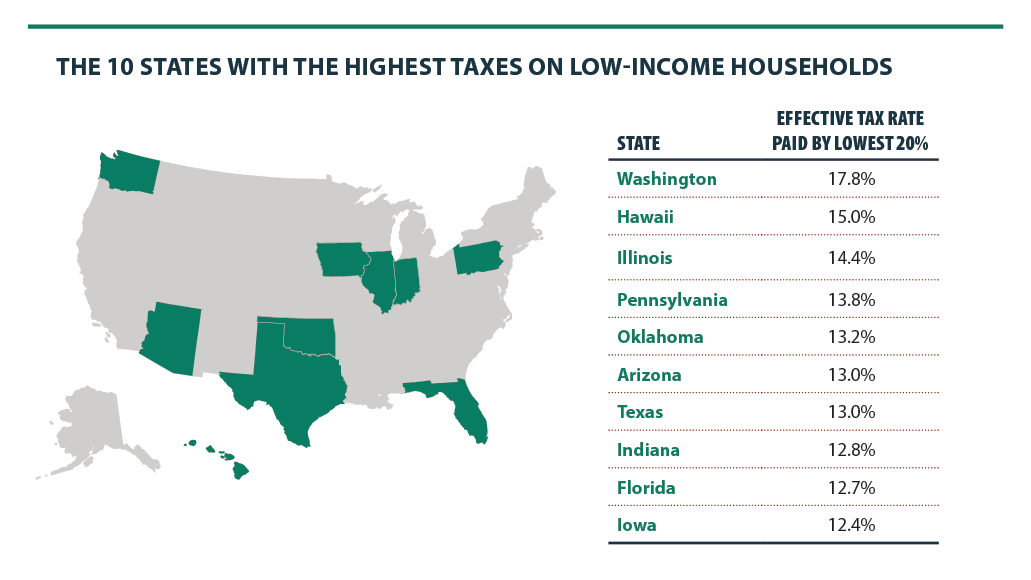

During an interview at his Ravenna home, which he bought for $26,000 in 1976 and has lived in since, Conway said, “We have the most regressive state and local tax system in the entire country.”

No state in the nation, Conway added, has engineered a tax system more punishing on the poor and helpful to the rich than Washington, one of only seven states – the others being Alaska, Florida, Nevada, South Dakota, Texas, and Wyoming – without an income tax.

Conway said all taxes should be eliminated – sales, property, business and excise taxes – and replaced with a simple, flat 10.4 percent state and local income tax with a $15,000 deductible.

If such a tax were enacted – a huge, huge if – a worker with a family of four making $25,000 a year, as say a fry cook at Denny’s, an Uber driver, or barista at a local coffee house, would pay $3,000 less per year than he or she does now.

For decades now, Conway has been lambasting the state’s regressive tax structure and he argues that the schism between rich and poor has grown only larger.

In his recent report, Conway, citing an analysis by the Institute of Taxation & Economic Policy, wrote, “Relative to their incomes, the poorest families ($24,000 or less) paid 5.9 times more in state and local taxes than the wealthiest families ($545,900 or more).

“Strapped with a 17.8 percent tax burden, the lowest-income families had to work 9.3 weeks out of the years to pay their annual state and local tax bill. With a 3.0 percent tax burden, the highest-income families had to work only 1.6 weeks.”

To which Conway groused, “That’s pretty astounding. I was tempted to use the term ‘indentured servant’ in the report.”

Lacking an income tax, complained Conway, the state and local tax burden on Washington families earning $244,000 a year – the average personal income of an Amazon employee – is only 6.4 percent.

In the report, Conway says that the total annual subsidy to Amazon’s 53,000 employees in Washington amounts to an estimated $517 million.

“While Amazon employees pay only 6.4 percent of their income on taxes,” Conway wrote, “the poorest 20 percent of Washington families (those earning less than $24,000 per year) pay 17.8 percent. This means that the lowest income families have to work 9.3 weeks out of the year to pay their state and local tax bill, while Amazon employees have to work only 3.3 weeks.”

Conway sent his report to every member of the King County council member, to every member of the Seattle City Council, to every state legislator, and to Jay Inslee, Jenny Durkan and Dow Constantine.

So far, said Conway, only Constantine has shown any interest in serious tax reform.

In 1932, with hopes of reducing the tax burden on farmers, 70 percent of the voters in Washington enacted a graduated income tax. But when the business community challenged its legality, the Washington State Supreme Court ruled in a 5-4 decision that the tax was an “unconstitutionally non-uniform property tax.”

Indeed, how close we came. Said Conway, “If just one more judge said the graduated income tax was not a property tax or had we just gone for a flat-rate income tax, we’d have an income tax today.”

Asked whether we might see an income tax enacted in our lifetime, Conway chucked and said, “Well, I’m 75 years old, and I’m not going to hold my breath.”

I was on board when I saw Ellis has a beach home in Manzanita–a favorite place for us! Actually, I was on board years ago when Bill Gates Sr. was the spark plug for an income tax. Ellis, Danny Westneat and especially Dick Conway make the case. A fair, progressive income tax is the best tool I know to battle inequality. I lived and worked under such a tax in Oregon, which once had the most progressive income tax in the nation; it’s been eroded somewhat over the years, but is still far superior to our disgraceful system. Could we inject this idea into our political discussion?