Gaze down at our fair state from cyberspace and the numbers begin to paint a curious picture of who owns Washington real estate. Fewer landowners may vote (or live) here than you might think. A bill written up this session to fence off your neighborhood from Wall Street begged the expensive question of just how many people live in what they own.

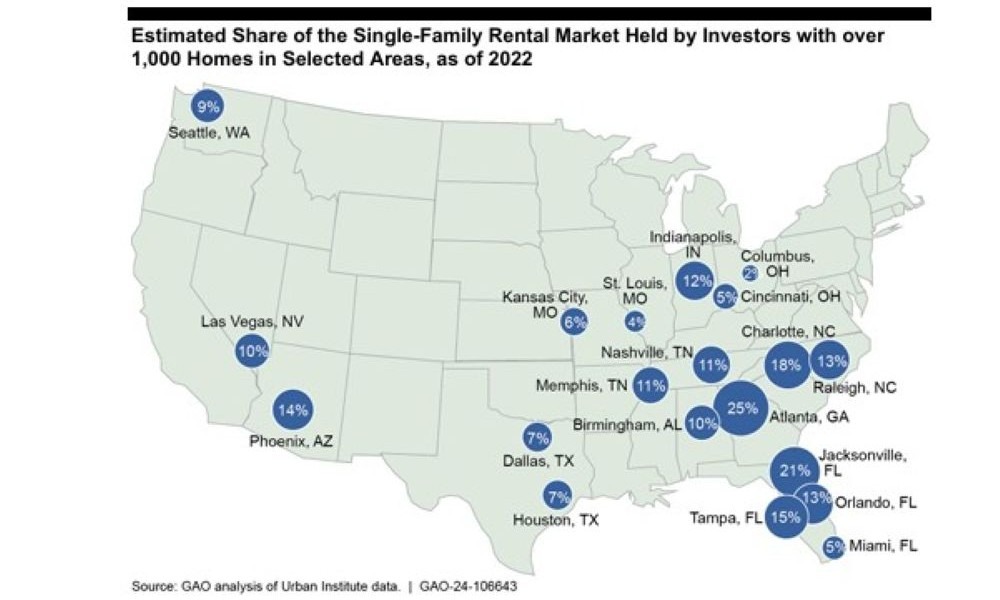

That bill in question from Sen. Emily Alvarado aimed to cap the number of houses private equity firms could put under their belts. The Seattle Democrat’s proposal was inspired in large part by the Emerald City’s allure to investors. As much as nine percent of its single-family rental homes were owned in 2022 by real-estate players with more than 1,000 houses in their pockets, per federal data. That’s in the neighborhood of 15,000 houses.

Washington is many thousands of homes short of its goal to meet mid-century demand of a million more homes. Wall Street money is alleged to drive up home prices, dry up housing stock, and elbow would-be home buyers out of the market. In that scenario, hot housing markets like Seattle’s could boil over.

The crux of this story is hard data on the above — or rather, lack thereof. Private equity is private, after all. Still, the concentration of out-of-state homeowners can give us an inkling of what’s catching their eye. You can thank Alex Alsup and Matthew Klovski over at Regrid who map out the matter in part below using street addresses, land-use classifications, and mailing addresses for property-tax bills.

Based on their findings, some 5 percent of American homes are owned by someone out-of-state in 2023. Those someones could include any number of local landlords, non-profits, hedge funds, and heirs to grandma’s house.

Keep in mind plenty of owners can use law firms or offices for their mailing addresses, possibly understating true out-of-state ownership, so consider the following numbers conservative.

Unsurprisingly, the picturesque shores of the San Juan Islands were the top locale in Washington for out-of-state homeowners, who are likely sitting on a wealth of vacation rentals. Said homeowners owned some 17 percent of San Juan County real estate, where 22 percent was not owner-occupied, per Regrid.

It might—or might not—surprise Seattleites to see that absentees own a large chunk of the city’s core. That includes the University District, South Lake Union, the Westlake area, and thereabouts. The lion’s share of those abodes are likely the kind of small rentals sprinkling Seattle.

Nailing down who these out-of-state homeowners are is a part of the equation Regrid and lawmakers will both be interested in cracking, especially as the issue catches fire in the other Washington.

Meanwhile in this one, the Attorney General is going after a cadre of alleged slumlords from out of state. Among the accused are California-based property management company, FPI Management, Inc., and a suite of landlords behind five Western Washington apartment complexes catering to low-income seniors. (The property owners in question are Vintage Housing Holdings LLC; Amcal Multi-Housing LLC; Vintage at Everett 2, LP; Amwa Cedar Pointe Fund, LP; Vintage at Sequim, LP; and Vintage at Tacoma, LLC.)

The AG’s office alleges FPI and crew charged higher-than-advertised rents based on area median income rather than personal income. (The former tends to be the higher of the two.) Also, the state alleges tenants were set up in homes with black mold and torn flooring, while promised amenities like pools and computer rooms were either closed or nonexistent. The company’s so-called “luxury” complexes were also targets for theft and vandalism, per the AG’s complaint.

The AG’s office alleges the above defied the state’s Consumer Protection Act and is looking for north of $12,000 per violation plus restitution for tenants and court costs. The proverbial ball is now in Snohomish County’s Superior Court.

This story also appeared in the author’s website, The Washington Observer.

Discover more from Post Alley

Subscribe to get the latest posts sent to your email.

Just another piece of evidence about how the Obama administration’s efforts to address the 2008 Financial Crisis were an absolute failure which resulted in exacerbating income inequalities and paved the way for populism and authoritarianism.

From the GAO report:

“Millions of homeowners defaulted on their mortgages during and immediately following the financial crisis of 2007–2009. Large “institutional” investors with access to cash or low-cost financing purchased foreclosed single-family homes at a discount at auctions across the country.”

Jamie Dimon and his quants caused the crisis through “financial innovation” that they didn’t understand. And yet Wall Street was bailed out. Absolutely no one was punished. The Fed’s solution was to dilute the risk carried by financial firms by lowering interest rates and printing scads of dollars. Dollars which inflated asset prices and made those holding such assets even richer.

A decade of low interest rates further spawned consolidation and facilitated investment schemes that don’t really do anything to improve our lives. Stock valuations rose dramatically as they are inversely proportional to interest rates.

As to these institutional investors, they don’t really care whether or not the homes provide housing to families. The intent is simple to make money or to shelter it. It wouldn’t be surprising to see foreign ownership elevating prices as the US is known as having extremely loose controls and real estate is means to make clean-up dirty money.

The working class sees how all of this plays out. They can’t put a finger on the cause but they know that there is no one fighting for them. And that is how we get to where we are today.

It’s damned if you do, damned if you don’t. Biden is taking the flack for pumping *too much* money in the economy during COVID. Both Obama and Biden oversaw responses to financial crisis with bipartisan support from Congress. But yeah, keep blaming people no longer in power instead of holding current electeds accountable; there are no time machines!

I’m simply answering the question of “how we got here”.

MIT’s Simon Johnson and James Kwak in their book “13 Bankers: The Wall Street Takeover and the Next Financial Meltdown (2011)” document the alternative which was to force the banks into receivership with the federal government re-capitalizing the banks. It was a conscious choice by Obama’s Treasury Department to protect Wall Street financiers and benefactors of the Democratic Party. Congress willingly went along.

Maybe only Elizabeth Warren and Bernie Sanders understand fully the threat to democracy posed by corporate consolidation. No wonder both are vilified by Trump who understands the threat they pose to his benefactors. No wonder that Wall Street’s Senator Chuck Schumer sidelines them.

So Seattle does not have a “missing middle” housing deficit, it instead has an institutional ownership problem?

Rents have been flat for several years so when refinancing-time rolls around those institutional owners may well want to sell and move to greener pastures. Eventually that should help with the recent, and stark, affordability problem here.

Not only is it hard to get the actual percentage of homes owned by investment corporations, it seems to me likely to be hard to identify investment corporation purchasers for enforcement of the bill.

This is an excellent idea, but I hope someone is walking through the process to make sure it can be reliably enforced. It’s an old story for agencies charged with tracking down drug etc. money laundered in real estate – shell corporations and other such legal obfuscations make it very difficult. Same problem with foreign investment.

What the state can easily do very effectively, is tax capital gains enough to make investment unprofitable. This just turns the problem around, because I think there’s a general consensus that homeowners should at least be able to profit from the sale of the home they’ve been living in – that’s easy – and likely we’d want to give small local slumlords a break. But I’d expect it to be easier than counting the homes owned by a buyer representing an investment corporation.

Does speculative investment make housing more expensive? I can’t see any “maybe” about it. Big money comes out of it, and that you know who that money came from.

Data point? Models?

Garbage in – Garbage out.

My views are that at the State level we inflate the data and then pass as a requirement to local jurisdictions who fall all over their “planning selves” to build – withe the help of the BIA and others – more “affordable” homes or “middle-middle” homes or whatever the latest terminology may be.

As a former County Planing Commissioner I speak with some knowledge – old knowledge but don’t think the game has changed that much . Everyone gets accolades. Everyone makes money. Some affordable homes get build, usually by expanding the GMA and contributing to urban sprawl because where do you build? Duh, where land is cheap!

Personally I am not not concerned if owners don’t occupy their property or if they rent it to others. I am not bought into the legislature’s obsession about “rent control” either. Senator Cleveland is right. We will rue the day we jumped into this mess.

Nor do I believe in “gouging” the poor. If the legislature wants to subsidize, do it directly and tell us the actual cost…..don’t just “roll it into the big budget” where you need to be a student of government to understand where the money actually goes…”who gets and who gives.”